A Case for Yongye

posted by The Traveller on Saturday, March 20, 2010

Yongye International (YONG) is a Chinese producer of liquid organic fertilizer and animal nutrients for the agriculture industry. The liquid plant products are typically applied together with normal fertilizer and are proven to increase the yield of wheat, potatoes and a variety of vegetables by up to 30%. The animal product is a powder that is mixed with normal feed and currently only targeting dairy farms. Its natural anti-biotic type properties help decrease inflammation and pain which occurs as a result of milking.

Both these products are based on something called 'fulvic acid' which is derived from humic acid that is typically extracted from coal. Yongye has a proprietary extraction process for high-quality fulvic acid which, so the company claims, allows it to create products that are more effective than other fulvic acid mixtures on the market.

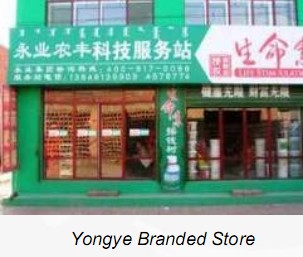

Knowing that marketing to farmers is crucial in this business, Yongye has found a unique way of distributing their products. The company currently has a network of 9,110 branded stores in nine provinces, two autonomous regions and several test markets in northern, central and southern China. The exterior of those stores is decorated with Yongye color and banners, and inside their products are prominently displayed alongside promotional materials provided and posters with village-specific case studies that demonstrate a farmer's incremental revenue, original investment and harvesting time saved from using their products. By the end of 2010, the Company plans to expand its total number of branded stores to more than 20,000.

Knowing that marketing to farmers is crucial in this business, Yongye has found a unique way of distributing their products. The company currently has a network of 9,110 branded stores in nine provinces, two autonomous regions and several test markets in northern, central and southern China. The exterior of those stores is decorated with Yongye color and banners, and inside their products are prominently displayed alongside promotional materials provided and posters with village-specific case studies that demonstrate a farmer's incremental revenue, original investment and harvesting time saved from using their products. By the end of 2010, the Company plans to expand its total number of branded stores to more than 20,000.This strategy is also the key to understand YONG's very positive business outlook:

From 2010 to 2012, Yongye expects to achieve at least a 50% annual growth rate in revenue through geographic expansion into new markets, increased penetration in existing markets, additional marketing and brand-building efforts, and expanded production capacity. During 2010, the Company also expects to build a new manufacturing facility nearby, which is expected to be capable of extracting humic acid from coal and producing 20,000 tons per year of the Company's liquid plant product and 10,000 tons per year of its powder animal product. The Company's current manufacturing facility operates at almost full capacity to meet peak season demand and inventory requirements. In addition, the Company plans to acquire certain Shengmingsu distributors that have especially strong channel networks. The Company also intends to improve its cost structure and enhance its profitability by gaining greater control over its supply chain and distribution network through a vertical integration strategy.This vertical integration strategy is coming along well. Securing humic acid supplies, the base material for all of YONG's products, is currently the largest component of cost of sales. Last December the company raised $69 million in a public equity offering with the intention to secure their own humic acid supplies which would both secure long-term growth and substantially increase gross margins. Then earlier this month the company announced the acquisition of an undeveloped lignite coal resources project in Inner Mongolia for about $35 million.

Strong Growth

| FY 2009 | FY 2008 | Change | |

|---|---|---|---|

| Revenue: | $98.1m | $48.1m | +104.0% |

| Gross Profit: | $52.1m | $24.9m | +109.2% |

| Gross Margin: | 53.1% | 51.8% | |

| Operating Income: | $31.4m | $13.7m | +129.2% |

| Operating Margin: | 32.0% | 28.5% | |

| Adjusted Net Income: | $26.2m | $11.2m | +133.9% |

| Net Margin: | 26.7% | 23.3% | |

| Earnings per Share: | $0.83 | $0.56 | + 48.2% |

In 2009 Yongye demonstrated strong growth by all metrics: revenues and gross profit more than doubled for the year, gross margin expanded by 130 bps and operating costs have been kept under control very well as operating margins improved even more (350 bps). At the current share price of $8 and trailing earnings of $0.83 per share, YONG is currently valued with a TTM P/E of 9.6 which is well below peers like CGA or CAGC. 2009 EPS growth was slower relative to the other metrics due to the huge share offering in December which resulted in a substantial dilution of about 30%. I see this offering and subsequent acquisition of the coal supplies as a big success for the company and the driver for sustainable future growth. The offering price of $7.50 will likely serve as a floor in the current correction.

2010-2012 Projections

Yongye's guidance for the next three years was reconfirmed last week with at least a 50% annual growth rate in revenue. Margins should further improve as I have pointed out and as the company only needs about 50% of the raised $69 million for the coal acquisition it should be left with plenty of cash even after constructing the new manufacturing facility which should limit future dilution. To be conservative I am attempting a 2010-12 projection with just 50% annual revenue growth, flat net margins and 10% annual dilution.

| FY 2009 | FY 2010 | FY 2011 | FY 2012 | |

|---|---|---|---|---|

| Revenue: | $98.1m | $147.1m | $220.7m | $331.1m |

| Income Tax Rate: | 15% | 15% | 25% | 25% |

| Adjusted Net Income: | $26.2m | $39.3m | $54.4m | $81.6m |

| Shares Outstanding: | 31.3m | 34.5m | 37.9m | 41.7m |

| EPS: | $0.83 | $1.14 | $1.44 | $1.96 |

YONG is currently followed by three analysts who all rate the stock a BUY: Oppenheimer (price target $12.50), Roth Capital ($15.00) and Rodman & Renshaw ($12.00). The most recent update from Rodman & Renshaw calls for FY2011 revenues of $212m and EPS of $1.53 which makes their $12 target very conservative. I'd like to follow Roth with my projections and believe the stock should be fairly valued at $15 or roughly 10x 2011 earnings. Given the high and likely sustainable annual growth rate the stock could see much higher levels if it attracts enough interest from institutional investors (as it should). Look at CAGC's share price development and you can see what kind of multiples are possible in this space.

I am adding a half position of YONG to the China Model Portfolio at Friday's close of $8.02. My 12-month price target for this position is $15.

6 Comments:

As solid and impressive as this company is, and as much as I believe your price target is likely, the one near term drawback is that there is a specialty fund out there that is willing to sell shares on every single bounce. They've gone from roughly 4.5 million shares to around 4 million in the last month. If you check the Form 4s you'll see that they consistantly sell shares in blocks of 20k+ every time the stock moves. No way to tell when or if they'll continue the pattern but IMO that's been a factor in the stock's trading range. I wish they would just get it all over with and be gone. That's just my take after watching the stock for a few months. Nice article though, and the stock should get there someday. GLTY

Nice article. A few comments.

Your shares outstanding number is off. It should be closer to 45 million in 2010 on fully diluted basis.

The company also plans to come out with a press release in a week or two with its guidance for sales and operating income for 2010. 2010 EPS should be close to $1.

Mine purchase should increase the gross margin from low 50s to high 50s (at least) in 2011. If you model that out, you should get 2011 EPS close to $1.80. You could safely assume 15% tax rate.

Finally. Got in a bit high at $10. But if this pans out, could make at least a 20% profit. Plan to be patient, though, and ride it higher.

If you want to know about China different kind of business, stock exchange and other kind of information related to business study then this is best site having such great content. Infect, http://essaysmama.com/ have some additional information regarding the above topic.

t is always a pleasure for me to help you and others get the information they need to be successful! Tik Tok

Amazing post. I have read this blog. This blog is very informative for a lot of people. I want more similar topics about this post to increase our knowledge. Thank you for sharing and keep sharing. Visit site webstagram

Post a Comment

Subscribe to Post Comments [Atom]

<< Home