Now that we have the third quarter results for all the Chinese solar companies, let's have a closer look at the performance, numbers and developments in the industry.

Third Quarter 2011 Results:

Revenue

For our group of ten companies, third quarter revenue declined both sequentially and year-over-year. Revenue for the traditionally much stronger third quarter declined on average by 9.6% from the second quarter of 2011. Only four companies - Canadian Solar (CSIQ), China Sunergy (CSUN), Suntech Power Holdings (STP) and Yingli Green Energy (YGE) could keep the same level from last quarter, while three companies posted hefty declines of 20% or more: Hanwha Solarone (HSOL), JinkoSolar (JKS), and ReneSola (SOL).

Those are disastrous numbers, especially if compared to what happened just one year ago. For the third quarter of 2010, ReneSola posted sequential revenue growth of 41.3%, compared to a revenue decline of 24.2% this year. For Trina Solar (TSL) those numbers are 37.1% growth versus 16.8% decline, but we can pick any name in the group to illustrate the unusual downtown in the traditionally very busy third quarter this year.

If we compare the Q3 revenue numbers with those of 2010, the picture looks slightly better with a year-over-year decline of "just" 3.8%. Most of this decline comes from the primarily upstream (solar wafers and cells) companies in the group: LDK Solar (LDK), ReneSola, and JA Solar (JASO), which on average lost 36.4% of their 2010 revenue. If we take those three out of the group, the rest - primarily module producers - managed to post year-over-year revenue growth of 10.2%.

The big exception among the downstream Chinese solars is Hanwha Solarone (HSOL) with year-over-year revenue decline of 34.4%. This might be a huge warning sign, as five out of seven of HSOL's direct peers managed to grow their revenue over the same period. Please review the numbers for all ten companies in the table above.

POSITIVE: CSIQ, CSUN, STP, YGE

NEGATIVE: HSOL, JASO, JKS, LDK, SOL, TSL

Gross Profit and Margins

In the third quarter of 2010 all ten of our Chinese solar companies posted double digit gross margins, ranging from the high teens to well into the 30 percent area. Just twelve months later those margins have collapsed for 90% of the group, with five companies reporting negative gross margins. As to be expected, the smallest module vendors, China Sunergy and Hanwha Solarone, suffered the most, as the solar industry is - and will always be - an industry of scale.

Only three of the ten companies still posted worthwhile gross margins last quarter, the market and cost leaders among the Chinese module producers: Trina Solar, Yingli Green, and Suntech Power. Especially STP is standing out here. The company moved from last to first place in the group, as its margins only moderately declined, from 17.9% in 2010 to 13.3% this year.

Those numbers stand in stark contrast to two other downstream companies. JinkoSolar's margins collapsed from 25.4% in Q2/2011 - the highest of the group at that time - to 3.7% in just three months, the direct effect of a 21.4% sequential decline in revenue. And while Canadian Solar managed to actually grow revenue sequentially, its gross margins (2.4%) are no longer acceptable which suggests that the company's strategy was to generate revenue at all cost.

POSITIVE: STP, TSL, YGE

NEGATIVE: CSIQ, CSUN, HSOL, JASO, JKS, LDK, SOL

Net Income and EPS

One year ago, all ten companies in our group were nicely profitable with operating margins ranging from 8.4% (STP) to 26.4% (JKS) and positive earnings per share. In Q2/2011, half of the group was already posting losses, and for the third quarter only Yingli Green Energy managed to break even on an operating level. These are disastrous results for the industry, especially if we consider that half of the group posted significant year-over-year revenue growth.

All ten companies were forced to write off some inventory which impacted the bottom line. However, if we adjust reported net income for these inventory write-downs, nine out of ten companies have still reported negative EPS. Only Yingli Green Energy reported positive numbers on an adjusted basis with $0.08 per share excluding write-downs and $0.14 per share as reported by the company on a non-GAAP basis. Yingli's business development trends look far better than those reported by its direct peers.

POSITIVE: YGE

NEGATIVE: CSIQ, CSUN, HSOL, JASO, JKS, LDK, SOL, STP, TSL

Company Guidance Revisions: (since June 30, 2011)

Official company guidance and what the company says about its business prospects can be very telling about how well management understands its market. Assumed management actually intends to tell the truth and give a realistic business outlook. If they have been utterly wrong several times in the past, why should we put too much weight on their current outlook?

We have evaluated the officially published FY2011 guidance for all ten Chinese solar companies, and the only one that actually raised its guidance at some point this year was LDK Solar. In January, LDK raised its full year revenue outlook by an astonishing $600 million and guided for gross margins in the 23.0% to 28.0% range. In mid-March Chairman Peng addressed the investment world with "we have made great strides in positioning LDK Solar to take advantage of the growth in the global PV industry. We remain excited about the multiple growth drivers we see for our business and believe we are well positioned for success." LDK reiterated its revenue guidance and raised the low end for gross margins by another percentage point.

Management kept this guidance until well into the third quarter when it was already very obvious that nothing of this will materialize. And for the third quarter the company reported a 30% decline in revenue with negative gross margins. Consequently, LDK's current FY 2011 guidance has been lowered by almost 40% from levels that were still official company outlook in August.

While the industry downturn forced nine of our ten companies to lower FY2011 guidance in the second half of this year, it is important to note that several names have not lost their credibility and have given a more or less realistic outlook at the beginning of the year. The only one that kept its original shipment guidance unchanged is Canadian Solar (CSIQ), while both Suntech Power and Yingli have lowered it only moderately. Those three are also the largest module vendors, based on Q3 revenue, while the small players in the group, CSUN and JASO, were forced to slash their guidance by at least 25%.

POSITIVE: CSIQ, STP, YGE

NEGATIVE: CSUN, HSOL, JASO, LDK, SOL

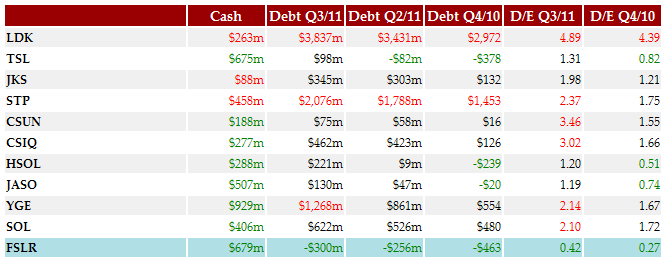

Debt Situation:

Net Debt (Debt): Total Liabilities - Total Current Assets (ex Inventories)

Debt to Equity (D/E): Total Liabilities - Total Shareholders' Equity

The debt situation is rapidly deteriorating for all 10 companies, and as the outlook for the industry is very negative for at least another 2-3 quarters, this is not going to become even worse. Further EPS losses are very likely for Q4/2011 to Q2/2012, probably even into the third quarter next year. While Trina Solar (low net debt) and Yingli Green Energy (large cash position) both look safe at this point, its huge debt burden could turn out to be a bigger problem for Suntech Power.

For LDK Solar the picture looks very bleak. With negative gross profit, a low cash position and rapidly deteriorating revenue, LDK is already running low on working capital, and if we consider the interest expense on its gigantic debt load something will have to happen next year to resolve this situation. If the company wants to survive this downturn, a debt to equity swap seems unavoidable, which means there is very little value in LDK's stock.

POSITIVE: JASO, TSL

NEGATIVE: CSUN, CSIQ, JKS, LDK, STP

Summary:

Third quarter earnings results for our group of 10 Chinese solar companies were generally weak, with only YGE (and to a lesser degree STP) providing some positive headlines. End markets are supposed to remain challenging for at least another 2-3 quarters with an unresolved debt crisis in Europe, massive overcapacity issues in the industry, high inventory levels, and ASP's rapidly declining. Despite collapsing end prices there was no meaningful demand uptick in the traditionally strong third quarter, and the near future brings us unfavourable weather conditions for all of the industry's strongest markets.

All signs point to a period of painful consolidation in the industry that is coming much earlier than anticipated. The weak players will be shaken out and eventually the industry will turn into oligopoly where only a handful of players will dominate the market. Third quarter results are a good indication of who will make it and who might eventually vanish over the next few years. With no positive catalysts to be expected over the next few months, it is probably to early to jump back into the sector, but the survivors will most likely come out stronger than before, in an industry that is here to stay.

Based on this analysis of business metrics and third quarter results, here is my take on the survival chances for all ten Chinese solar companies:

GOOD: YGE

NEUTRAL: CSIQ, STP, TSL

BAD: CSUN, HSOL, JASO, JKS, SOL

VERY BAD: LDK

Labels: China, CSIQ, CSUN, HSOL, JASO, JKS, LDK, SOL, solar, STP, TSL, YGE

18 Comments:

Thanks

Thanks for letting know about Chinese solar companies quarter result and how they've performed to achieve such revenue. I'm not sure if anyone here has used PanXpan finance summary module. Its definitely a low cost way to monitor your business revenue and expenses.

Thanks

This analysis clearly showing CSUN, HSQL, JASO, JKS, SOL, LDK companies are in great danger in their company financial management. They need to come up with better ideas for sure to rise up the Chinese solar company market again. If you've struggled to figure out whats driving your expenses, take a look at this analytics software (finance summary module from PanXpan). It helps you research and share your business's expenses and revenue with your team.

A detailed Analysis of Chinese Solar Companies with their Revenue Exchange rate. We can see the graph as above in the post. It's really good collection by the author of this post. On the other hand, I like to get similar kind of source lilke http://professionaldissertationwriting.org/ then as a business study student i like to read about this kind of posts.

en el momento en que Rolex abrió las relojes replicas ventanas de su stand baselworld (se puede llamar fácilmente una gran casa o un replicas rolex relojes gran boutique de 3 pisos) que estábamos asistiendo a la conferencia de prensa Tudor, donde se nos presentó el nuevo y replicas relojes genial de Bahía azul negro, Mario – quien no estuvo presente en b-mundial nos ha enviado un mensaje de texto con un enlace a las novedades rolex.

You will achieve a success aussieassignmenthelp quickly when in good feelings, good thoughts, and urge all those good things.

I think this is an informative post and it is very useful and knowledgeable. therefore, I would like to thank you for the efforts you have made in writing this article. Zonnepanelen kopen

Wow, cool post. I'd like to write like this too - taking time and real hard work to make a great article... but I put things off too much and never seem to get started. Thanks though. Installateur zonnepanelen

Wow, cool post. I'd like to write like this too - taking time and real hard work to make a great article... but I put things off too much and never seem to get started. Thanks though. Zonnepanelen kopen

Easily, the article is actually the best topic on this registry related issue. I fit in with your conclusions and will eagerly look forward to your next updates. Zonnepanelen

You actually make it look so easy with your performance but I find this matter to be actually something which I think I would never comprehend. It seems too complicated and extremely broad for me. I'm looking forward for your next post, I’ll try to get the hang of it! Zonnepanelen kopen

Cool stuff you have and you keep overhaul every one of us Installateur zonnepanelen

I'm happy to see the considerable subtle element here!. SEO

thanks

faceforpc

It was nice to read your blog. It's pretty much relevant to my BTEC Assignment Help client's topic I am a writer and help students with assignments for MBA, Nursing, Laws and Engineering students.

An in-depth look at Chinese solar companies and their revenue exchange rates. The graph is seen above in the post. The author of this post has put together an amazing collection. On the other side, as a business studies student, I enjoy finding similar sources of interesting topics and reading about them.

All assignments are based on in-depth research of relevant scholarly sources and are written from scratch according to the instructions of our customers

Post a Comment

Subscribe to Post Comments [Atom]

<< Home