China Small Caps Rallying Hard

posted by The Traveller on Saturday, October 16, 2010

You might think it is always again surprising how quickly market sentiment can change, but on second thoughts you will probably realize that in the end it is always value that attracts money, and that it was only a matter of time before demand for low-valuation and high-growth Chinese small caps would pick up again. Those of you who haven't been questioning their value investing approach this summer, in times when short-seller attacks and depressed Chinese domestic markets dominated the news in the sector, those of you will already be sitting on big returns now.

I wrote about The Turning Point and Don't Be Afraid here on this blog. Granted, the timing was lucky, but an investment approach where you will do your own quality due diligence, go for undervalued high-growth stocks at a time when nobody else wants them, when you can "buy 50 cents for a dollar", such a strategy will almost always result in above average returns. The key here is due diligence. Do your own research and don't follow anyone blindly, especially not in emerging market names and U.S.-listed China stocks. You need the appropriate confidence in your holdings to get through times of big price swings and high volatility.

One factor that has been driving up stock prices - and likely will continue to do so - is short covering. If you look at the China stocks with the highest short interest, you find the top three names on this list to outperform the whole sector on strong volume. Just look at yesterday's numbers (Friday, October 15): RINO International (RINO) gained 5.6% on 2.8x average volume, the stock is up 23.8% for October. China-Biotics (CHBT) gained 12.7% on 2.3x average volume, the stock is up 18.4% for the month. And China MediaExpress (CCME) gained 15.5% on 5.3x average volume for a total October return of a staggering 58.8%.

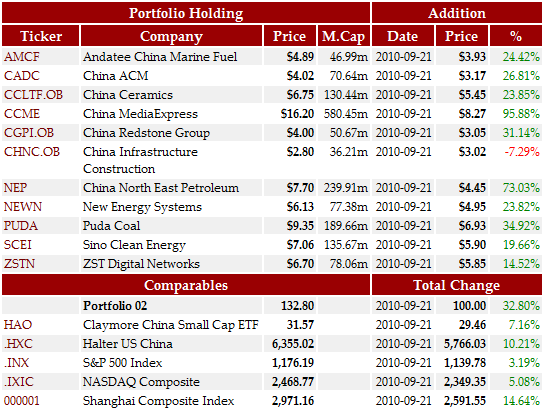

China MediaExpress is also the top-performer in the Trading China Model Portfolio as the stock has almost doubled since we started the portfolio on September 24:

Our model portfolio is now up 26.02% in just three weeks, and only one stock (Longwei Petroleum, LPH) is closing in on the target we have set. All those names have further room to grow, but I am especially excited about the recent performance of Tianli Agritech (OINK), which has found its way back to the IPO price. I will probably do an article about OINK next week to point out some of the exciting facts about this company.

Two popular value-investing strategies are to invest in stocks with the lowest Price-to-Earnings or Price-to-Book ratios. Please do always keep in mind that there might be very good reasons why those stocks are trading at seemingly low multiples. It is absolutely necessary that you take a long and in-depth look into those companies' filings, news and financials before you start a position in the stock. Trading China is tracking those groups with temporary portfolios since September 21st, and the returns so far have been stellar:

12 China stocks trading above $3.00 with the lowest P/E-ratio

12 China stocks with the lowest Price-to-Book ratio

And finally, we are tracking another group of stocks that we found most significant for measuring a sentiment shift in the China small caps group: those names that have been attacked most heavily by short-sellers and bashers throughout the summer. Trading China makes no judgment on the validity of those fraud claims, this is for every individual investor to decide. And I want to point out that many of those stocks bear the additional risk of becoming a target again as soon as the current rally in the sector comes to a halt - as we all know nothing can run up forever, and the massive gains in recent weeks will have to get consolidated at some point. However, the market seems to have made up its mind about the fraud claims (for now):

So... where do we go from here in the China small caps space? Nobody knows, and everyone who claims to know is of course just speculating. Maybe we will see a rally similar to what has happened in November/December of 2009. The recent performance of the Chinese domestic markets would certainly point in this direction: The Shanghai Composite is up more than 300 points or almost 12% in the past six sessions alone, quickly approaching the 3000 mark, a level it hasn't seen since April.

Valuations are still low, very low, for the majority of U.S.-listed China stocks, which also leaves room for a continued rally. And the slow but steady appreciation of the Chinese currency is another positive for the group, as all those companies report in U.S. Dollar and derive the majority of their revenues in Chinese Yuan. Right now there is nothing that points to an immediate end of the current up-trend, however don't forget that just four weeks ago the general market was avoiding Chinese stocks like the plague.

My strategy would be to stick to your investment strategy, don't get overexcited and keep the discipline that you need for investing in this space. Follow the trend for as long as it holds - and it doesn't necessarily end with a few down days we will certainly see along the way - but most importantly: protect your gains and don't forget to take profits along the way.

1 Comments:

I very much appreciate this article and your constant reminder of doing

the proper due diligence! Your check list for quality with particular

emphasis on rule #1 has rewarded my portfolio in the recent past. I find

the current pull back necessary. A recent addition to my portfolio has been

CCCL which I located here.

I can only hope that Roth Capital and Grant Thornton are doing proper

due diligence before the secondary is priced and offered.

I thank you for your very informative site.

Post a Comment

Subscribe to Post Comments [Atom]

<< Home