Tianli Agritech - a Hidden Gem

posted by The Traveller on Sunday, October 17, 2010

Tianli Agritech (OINK) is currently trading at $5.96, down 0.6% from their July 20 IPO price at $6.00 and down 6.4% from the October 15 high at $6.37. The Trading China Tracker Score is 12 (Strong Buy).

Tianli is a hog breeder in the Wuhan area, Hubei province, in central China. On July 20 the company went public on the Nasdaq Global Market by selling 2,000,000 common shares at a price of $6.00 per share for proceeds of about $9.6 million. Post-IPO the company has about 10.125 million shares outstanding which gives it a current market capitalization of about $60 million.

Pork is the Meat of Choice in China

The United Nations Food and Agricultural Organization statistics show that China has more hogs than the next 43 pork-producing countries combined. Pork accounts for approximately 65% of total Chinese meat consumption, and total pork consumption for 2010 is expected to rise nearly four percent to approximately 50.56 million metric tons, which follows a five percent increase in 2009. Demand for pork is growing fast, partly due to changing diets, with rising incomes leading to more consumption of meat.

China's hog industry is in the midst of a transition from a large number of small household farms to larger, more commercial farms. Meat hog production in the PRC is currently dominated by backyard farms (those that sell 5-10 hogs annually) and small farms which sell less than 100 hogs annually. Currently farms that sell more than 3,000 hogs annually account for less than one-half of a percent of all hog farms in China.

However, the government is giving huge incentives to encourage growth and consolidating the hog breeder industry towards larger commercial farms. Similar to what is currently happening in other industries, the government is trying to eliminate substandard capacities in both the hog breeding and hog slaughtering - Zhongpin (HOGS), China Yurun (1068.HK) - industries. In 2009, the Chinese government gave subsidies worth approximately $366 million to invest in larger farms, $95 million to subsidize high-quality breeding swine and $307 million to large hog-producing counties. These subsidies have resulted in a shift toward larger farms, which benefit disproportionately from such incentives.

Tianli Already a Strong Player in its Region

Tianli Agritech currently owns 9 hog farms which are expected to reach an annual capacity of 130,000 hogs by the end of 2010. That makes the company the second largest hog producer in Hubei, and only two other companies have annual production capacities of 100,000 or more hogs (competitor Tianzhong reached 140,000), with the next largest competitors having annual capacities of 30,000 hogs or less.

This puts Tianli in an ideal position to grow both organically and through acquisitions. According to the prospectus, the average selling price for a hog farm with an annual capacity of 10,000 hogs is approximately $2 million. The total cost for bringing a new farm to Tianli's targeted full capacity of 20,000 hogs is about $2.5-3.0 million, which indicates that the proceeds from OINK IPO could be sufficient to expand total capacity by about 50%. Besides bringing their 9th farm to full capacity, the company has not yet announced any concrete plans for future acquisitions.

Strong Pricing Trends and High Margins

Tianli is trying to distinguish itself from other hog producers by focusing on the health and quality of their hogs without relying on chemical feed additives. The company has developed their own successful premix feed which helped building a reputation as a producer of high-quality, low-pollution and low-additive pork products. The effect of this strategy can be seen by the high and increasing percentage of high-margin breeder hogs sales, relative to lower margin meat hogs for slaughtering.

Only the highest quality hogs do qualify as breeder hogs, and Tianli has reached a breeder to meat hog ratio of 30:70. Breeder hogs have a gross margin of 57% versus 34% for meat hogs, and in the second quarter conference call Tianli management projected the ratio of breeder hogs - and accordingly also overall gross margins - to rise further.

Another reason for the superior margins is Tianli's proprietary feed mix. While most of their competitors have to deal with exploding feed prices due to record high spot prices for corn, the overall price for Tianli's feed actually decreased (see conference call recording).

Since the end of the second quarter of 2010 to date, hog and pork prices have increased approximately 20% primarily because (i) the government stepped into the market and built up frozen pork reserves in the first half of the year to stabilize the price and protect the interests of hog breeding farmers; (ii) the drought in south-west China and flood in south, north-east and other regions in China increased the price of agriculture products, including pork; and (iii) a better balance of supply and demand has been achieved.The hog cycle is in a new uptrend and hog and pork prices are expected to rise until reaching a peak around the Chinese New Year festival in 2011. Goldman Sachs noted in their latest 'China Food Prices Flash' (September 7, 2010) that "on the back of strong hog prices, in August the parity between pig and corn remained above the 6.0 breakeven level. The number of live hogs picked up slightly in July following stabilization in June. We expect live hog prices to remain strong later this year as it will take time for the supply and demand of hogs to rebalance."

(Source: Zhongpin 10-Q filing)

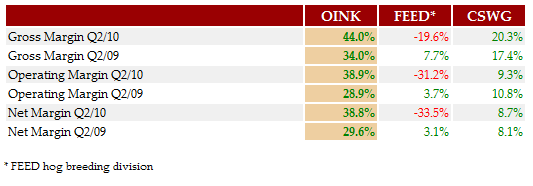

Due to the favorable margins for breeder hogs, Tianli can maintain a higher average selling price than the competition. For Q2/2010 Tianli achieved an average price of $211 per hog, $325 per breeder hog and $168 per meat hog. The $168 meat hog price is in line with competition from Sen Yu (CSWG, $177) but significantly higher than AgFeed's achieved price (FEED, $131) - AgFeed's livestock was heavily affected by floodings last spring.

Government Subsidies for the Hog Industry

Tianli's high net margins can be explained by the fact that the company receives substantial subsidies, business tax exemptions and government incentives in connection with their operation of hog farms in Wuhan. Under current Chinese law, the company is exempt from corporate income tax for so long as it operates as a hog farming enterprise. Additional subsidies include:

- A one-time payment from the city of Wuhan of RMB 1.5 million (approximately $220,000) for each farm that achieves an annual production capacity of 10,000 hogs.

- A one-time payment from the city of Wuhan of RMB 3.0 million (approximately $440,000) for each farm that achieves an annual production capacity of 20,000 hogs (including any previous grant).

- Government payment of RMB 100 (approximately $15) annually per breeder hog in inventory. In general, OINK receives credit for 600 breeder hogs for every 10,000 hogs it produces.

- Government underwrites a portion of the costs of hog insurance to cover losses in the event of disease outbreaks. The cost per productive breeder hog per year is approximately RMB 50 (approximately $7.30), of which the government pays approximately RMB 38 (approximately $5.60) and Tianli pays RMB 12 (approximately $1.70).

Valuation

Tianli Agritech has guided for full year 2010 net income of at least $7.5 million, and the company is well on track to achieve their guidance. Based on the assumption of a favorable use of IPO proceeds leading to a capacity expansion of 40% within 12 months, organically or through acquisitions, and based on stable market prices for Tianli's quality hogs (trend calls for rising prices), I would expect the company to grow net income by at least 40% in 2011 to $10.5 million. Based on the post-IPO share count of 10.125 million I am calculating with a 2011e EPS of $1.04, which translates into a current P/E-ratio for OINK of 5.7.

As OINK is a yet widely unknown new player on the market, has no analyst coverage, and only a limited history as a public company, I would not expect higher multiples than 8-10 for the time being. Possible catalysts for higher multiples are third quarter earnings which are due in November, news about acquisitions or generally use of IPO proceeds, industry news about rising pork prices and possible shortage of hogs going into peak season, and further stock price appreciation of larger peers in the Chinese meat industry (HOGS, 1068.HK)

2 Comments:

Among all the IPO ,I pick the ones of AMCF and CIL.

Both are traded in prices less than their IPO price.

In addition, both AMCF and CIL have the lowest pe and peg.

AMCF has estimated 2010 eps = 1,20 $.

CIL has estimated 2010 eps = 0,75 $.

in addition CIL's sector (LED sector) is the hottest sector. LED sector is like solar and wind energy. CREE and other LED companies have pe > 25 in USA.

jmho

This is a newly written blog that is of interest to see

https://orologioreplica.blogspot.com/

Post a Comment

Subscribe to Post Comments [Atom]

<< Home