China Watchlist for the Next 4 Weeks

posted by The Traveller on Monday, February 21, 2011

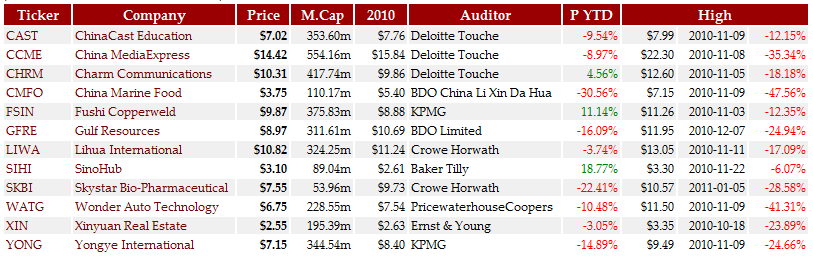

Lihua International (LIWA) is currently trading at $10.82, down 3.74% for the year and down 17.09% from its November 11 high at $13.05. The Trading China Tracker Score is 9 (Buy).

LIWA is currently trading at about 6x earnings for 2011 on a fully diluted basis. The company has a $15 million share repurchase program in place, a Top 10 auditor with a strong China team (Crowe Horwath), and additionally Deloitte has been contracted to do an internal control implementation and review. The stock has come under pressure from short sellers last year, and management responded with posting their Chinese SAIC filings on its website. Rodman & Renshaw confirmed the authenticity of those filings for both subsidiaries - Lihua Electron and Lihua Copper - and concluded that there are no inconsistencies between Lihua's SEC and SAIC filings. Rodman has a $20 target on the stock, and Global Hunter calls it "the single best pick in the US-listed China space."

We are waiting for the 10-K filing in early March, and possible FY 2011 guidance which we expect to come in around $1.85 earnings per share. LIWA's short interest is among the highest in the sector, having reached over 27% of the float by the end of January. We wouldn't be surprised to see another attempt to attack the stock before the annual report is filed, which we would use to start building a position.

ChinaCast Education (CAST) is currently trading at $7.02, down 9.54% for the year and down 12.15% from its November 9 high at $7.99. The Trading China Tracker Score is 5 (Hold).

ChinaCast is in the post-secondary education (universities) and e-learning business in China. Nothing much happened to CAST's stock price in the last two years. The stock closed in the $7-8 range both 2009 and 2010 and is now still trading at this level. But the company looks rock-solid and I wouldn't be surprised to see the stock finally breaking out to the low double digits this year.

We asked the company for a comment on the ongoing credibility crisis in the US-listed China sector:

Trading China: Can you reassure investors that your company is not a possible target for the SEC investigation?We are adding CAST to the Trading China Model Portfolio today.

ChinaCast: When ChinaCast was originally formed and did a Series A investment with Intel Capital and Hughes back in 2000, our US investors mandated that we use a Big 4 auditor (in this case, Deloitte Touche-DT) from day one and we've been using DT now for over 10 years. We actually went public via a traditional IPO on the Singapore Stock Exchange back in May 2004, which believe me is a much more vetted process than the reverse merger and in some cases IPO process to get listed on US exchanges. While we did do a reverse merger to move our listing from Singapore to the US, it was through a public tender offer process that was highly scrutinized by the Singapore Stock exchange regulators, the SEC, Deloitte, as well as the shareholders of both companies.

We are now a Delaware listed company (fully audited 10K reporting) and have been Sarbanes-Oxley 404 compliant for the past 3 years. I'm not sure how many other PRC companies listed in the USA file fully audited form 10K, have a Big 4 firm as their auditor for the past 10 years and are SOX 404 compliant but probably less than 10%. Our management team have a long, successful history of working in global multinational companies and have run other publicly listed companies and we have a very experienced, shareholder friendly board of directors.

In addition, the senior management team and board have purchased approximately $9.5M worth of common stock during the past year. We believe that is a clear differentiator and if any regulatory body were evaluating targets we believe this would send a clear message on where management stands in its conviction of the business and the numbers. With that being said, we also strongly welcome the opportunity to host investors and analysts to our corporate facilities, network operations centers and universities in China to meet our executives and to conduct due diligence at our facilities. (Michael J. Santos, President-International, ChinaCast Education Corporation)

Watchlist for the Next Four Weeks:

Model Portfolio Changes:

Lotus Pharmaceuticals (LTUS.OB) is currently trading at $1.84, down 28.96% for the year and down 38.26% from its November 10 high at $2.98. The Trading China Tracker Score is 14 (Strong Buy).

We are closing our position here for a loss of 1.08% or $52. The ongoing discussion about the expensive land purchase in Inner Mongolia will likely hang over the stock until the land is actually sold. We believe LTUS will continue to trade on depressed multiples for the coming months.

Trina Solar (TSL) is currently trading at $29.41, up 25.57% for the year and down 7.78% from its October 14 high at $31.89. The Trading China Tracker Score is 8 (Buy).

Trina Solar is set to report earnings this Tuesday. While we expect another beat and raise quarter, we also believe that the focus will shift to H2/2011 where solar bears will argue big oversupply pressure will be looming. Most solar stocks had a stellar year so far and a pullback is likely, especially after market leader First Solar (FSLR) will report on Thursday. First Solar's stock is massively overvalued compared to its Chinese peers and an expected sharp drop after the Thursday report won't leave the Chinese names unaffected. We are closing our position for a gain of 24.04% or $1,197.00.

JinkoSolar (JKS) is currently trading at $29.67, up 47.46% for the year and down 28.94% from its November 4 high at $41.75. The Trading China Tracker Score is 11 (Buy).

The second solar stock we are selling today is Jinko Solar, a relatively new player in the sector with a less established customer base and higher vulnerability to rising raw materials prices. JKS had a great run, but for reasons explained in the TSL paragraph, we feel it's prudent to take profits here. We are closing the position for a gain of 25.18% or $1,253.00.

6 Comments:

Herewith, there is a lot of common between the finances and credit as from the essential point of view, so according to the form of movement. At the same time, there is a significant distinction between finances and credit as in the essence, so in the form too. finmaxfx

This is very useful information about Chinese economics. We can get knowledge about the success of China. In future, China will become no. 1 superpower. Dissertation writing services.

Awesome post! Thanks for sharing the knowledge and informative information about China Watchlist for the Next 4 Weeks and keep up the good work. Best Dissertation Writing Services

Thank you for sharing this helpful information. Your suggestions help me work more effectively and silently every time I read it. In my spare time, I enjoy reading your blog posts and learning new things from them. I'd want to express my gratitude for your efforts. Outstanding work.

your content is really informative I want to read emotional content that's why I like to read mba assignment help service blogs where you can read the most knowledgeable content before that I did not see this type of content which is information

Thanks for this wonderful post! I really enjoyed reading your blog. Thank you so much for sharing. fulokoja special degree programmes admission 2023

Post a Comment

Subscribe to Post Comments [Atom]

<< Home