There has been enormous confusion last week, surrounding the deletion of more than 1000 microcap stocks, including many Chinese ones, from the OTC Bulletin Board. The daily list of changes for the OTCBB gives a reason for those deletions: "Failure to comply with Rule 15c2-11." Subsequently financial websites as Google Finance or Yahoo Finance will no longer list those securities as "OTC quoted", instead they will change the market segment to "Pink Sheets" or just "PINK" (example: Weikang Bio-Technology, WKBT, Yahoo Finance, Google Finance). Additionally, Yahoo Finance and most brokers will no longer use the ending ".OB" for those stocks, but replace this indicator with ".PK" for the Pink Sheets or "Other OTC".

What seems to be a negative development, a demotion for those stocks, is actually just a change of the quotation platform. There is absolutely no reason to worry for investors, those companies are still U.S. registered and fully reporting with the U.S. Securities and Exchange Commission (SEC). Price declines over the past week, following the deletion from the OTC Bulletin Board, are not justified, as the change was not caused by any action or inaction of the company, nor did the company fall short of its reporting requirements.

Here is a little bit more about the background. The OTC Bulletin Board was owned and operated by the Financial Industry Regulatory Authority, or FINRA, the Wall Street regulatory authority. In late 2009, FINRA decided to part with it to focus on its core business, and in September 2010 the U.S. investment bank Rodman & Renshaw agreed to buy the trademark and website in a deal that is expected to close this quarter. Rodman said it plans to expand its "quality services and products offered to the financial community," and wants to diversify its revenue base.

But long before that sale, a competing platform, OTC Markets Group, had emerged as the dominant player for OTC securities. At the end of 2010, about 94% of all market maker quotes were published on OTC Markets Group's platform vs. just 6% on the FINRA Bulletin Board. Most brokers have migrated from the telephone-based OTCBB quotation system to the electronic OTC Markets platform since 2008, but for the time being almost all OTC securities were dually quoted on both platforms. That is changing now.

A deletion notice on the OTC Bulletin Board website simply means that the stock has completely migrated to the OTC Markets platform and is no longer quoted on the OTCBB. However, OTC Markets is not recognized by most financial websites and brokers as "OTC", which led to the current "Pink Sheets" confusion. OTC Markets Group is a privately owned company that has its origins with the National Quotation Bureau (NQB). In June 2000, NQB changed its name to Pink Sheets LLC and introduced a financial information portal for unlisted securities under www.pinksheets.com. In April 2008, Pink Sheets LLC announced that it changed its name to Pink OTC Markets Inc., and finally this year, on January 18, they got rid of the "pink" completely to become OTC Markets Group Inc. The website has been renamed to www.otcmarkets.com since, and free real-time quotes are offered for all fully reporting securities on that site.

OTC Markets organizes OTC securities into three tiers, where OTCQB, their middle tier stands for "OTC-traded companies that are reporting with the U.S. Securities and Exchange Commission (SEC) or a U.S. banking or insurance regulator." A .CSV file of all stocks quoted on OTC Markets' platform is available online. Those tiers, also OTCQX and OTC Pink, are not recognized (yet) by most quotation websites and brokers, which makes it difficult for investors to identify an unlisted but fully reporting stock through a third party provider. Very few companies have informed investors about the platform change the way China Tel Group did.

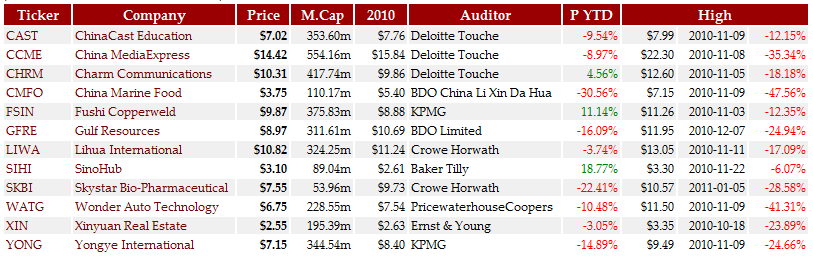

Trading China has set up a list of all Chinese OTC Securities (as of February 25, 2011) and their current quotation platforms: Chinese OTC Securities

Labels: China